Blog - Calculate Retained Earnings

Beginning Retained Earnings - is your Balance Sheet Out of Balance again?

I have had this discussion (and argument) with other Consultants on what to do about Beginning Retained Earnings (RE BegBal) - at the initiation of a consolidation application build and moving forward. This comes from the treatment of RE BegBal in whatever consolidation tool you are using. I am now writing it down and spreading it to anyone who will listen to try to make at least one thing in our lives simpler.

The two options are:

Option 1:

- Load RE BegBal from source systems into the RE BegBal in the first time period of the consolidation tool.

- After that point, RE BegBal is ignored from whatever periodic load is utilized, with a formula of some sort pulling forward the prior year-end retained earnings into the current year.

- Basically, RE BegBal is an input account in the first period and calculated going forward.

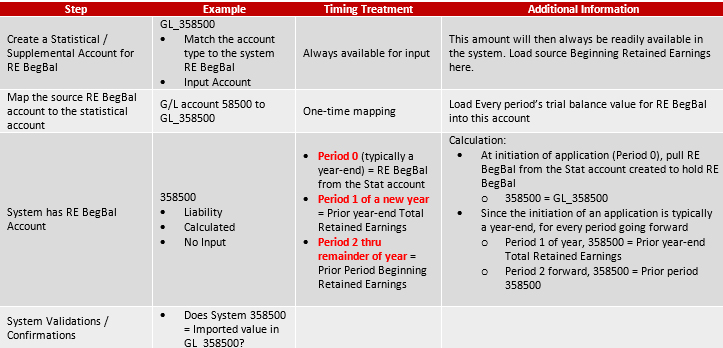

Option 2:

- Always load RE BegBal from source systems into a statistical account outside of the trial balance accounts.

- Use a formula to pull the balance from the statistical account into the body of the trial balance to initiate the consolidation system.

- Going forward from the system initialization, use a formula to pull forward the prior year-end retained earnings.

- Basically, RE BegBal is always input into the consolidation system and the calculation of RE BegBal in the balance sheet is always a calculation.

Overview

From a reporting perspective, RE BegBal shouldn't be changing, but we all know that is not always the case or a reality. Changes can occur a lot of times because of audit adjustments or a significant event in the business.

What happens when you put in a consolidation tool? And there are several tools out there to be sure. My preferred option (if you haven't already noticed) is Option 2 from above. This is a very simple process that can be applied to any consolidation tool.

- 1. It allows users and the business to begin the analysis when a trial balance data load is out of balance.

- 2. This process simplifies validations as well as mapping!

General Thought Process

Conclusions

As I noted earlier, from a reporting perspective, RE BegBal shouldn't be changing but has been known to do just that.

- RE BegBal needs to come from somewhere in order to kick-off the trial balance of a consolidation system.

- My issue is that if a source RE BegBal value is input into the RE BegBal account of a new consolidation system and is then allowed to roll (calculate) going forward, any mapping of the original account needs to be ignored going forward. In almost every instance I encountered, historical data is loaded and reloaded many times, so mapping needs to be modified back and forth. How many of you remember to do that every time?

-

If a source RE BegBal value is always loaded into a statistical account, the consolidation system RE BegBal can always be calculated:

- To initiate the balance sheet using the statistical account

- To pull the correct balance going forward as well.

-

Using a statistical account allows for:

- Stable mapping of RE BegBal

- Maintenance of RE BegBal as a calculated account

- Ability to always compare Consolidation System versus Source System RE BegBal. It can even be part of your system's data submission validation process.

- Why is this important? Besides any new mapping errors, the difference between the Beginning Retained Earnings values is often the source of an imported trial balance being out of balance.

Contact MindStream Analytics

The Consultants at MindStream can help you discover solutions and best practices for your consolidations. Fill out the form below for more information.

Partner SpotLight

Oracle

Oracle has the most comprehensive suite of integrated, global business applications that enable organizations to make better decisions, reduce cost